Simple Investing Guide for El Salvador: Best Beginner Digital Platforms

Back in 2021, when digital finance first made serious headlines in El Salvador—everyone was buzzing about bitcoin adoption, mobile apps, and the promise of finally democratizing investment. Like many locals, I wasn’t sure where to begin, even though I had some savings and plenty of curiosity. Fast-forward to today, and El Salvador’s investment landscape has changed completely. What really strikes me is how easy (and, sometimes, confusing) it now feels to open an account, make your first investment, and start growing wealth digitally. So, why does it still feel intimidating if you’re just starting out?

This beginner’s guide isn’t just another dry walkthrough. I’ll share my own missteps, highlight what’s worked for real Salvadorans, and break down exactly comment you can get started—with a step-by-step focus and loads of practical, regionally-relevant insights. The pace here is intentionally varied: dense details on key platforms, lighter moments about mobile trends, and honest reflections on what most guides miss. Let’s not waste any time—if you’re looking for the absolute simplest way to begin investing with digital platforms (without jargon, confusion, or hidden fees), this is for you.

Choosing Your First Investment Platform

The first time I helped a family member open an account, we spent over an hour comparing platforms—an experience that left both of us frustrated and, admittedly, more confused than informed. Let me make this simpler for you. I’ll break down Salvadoran-friendly platforms with a practical table (see below), honest commentary, and direct feedback from real users.

| Platform Name | Core Focus | Soutien local | Beginner Features |

|---|---|---|---|

| Alegra Inversiones | Local bonds, mutual funds | 100% Spanish, El Salvador phone support | Demo account, step-by-step onboarding |

| Binance | Cryptocurrency, global investing | Spanish, USDT/USD options | Education portal, virtual portfolio |

| Plus500 | Global stocks, ETFs | Partial Spanish, chat support | Low minimums, risk demo |

| eToro | Stocks, crypto, copy trading | Spanish, large community | Copy portfolios, social feeds |

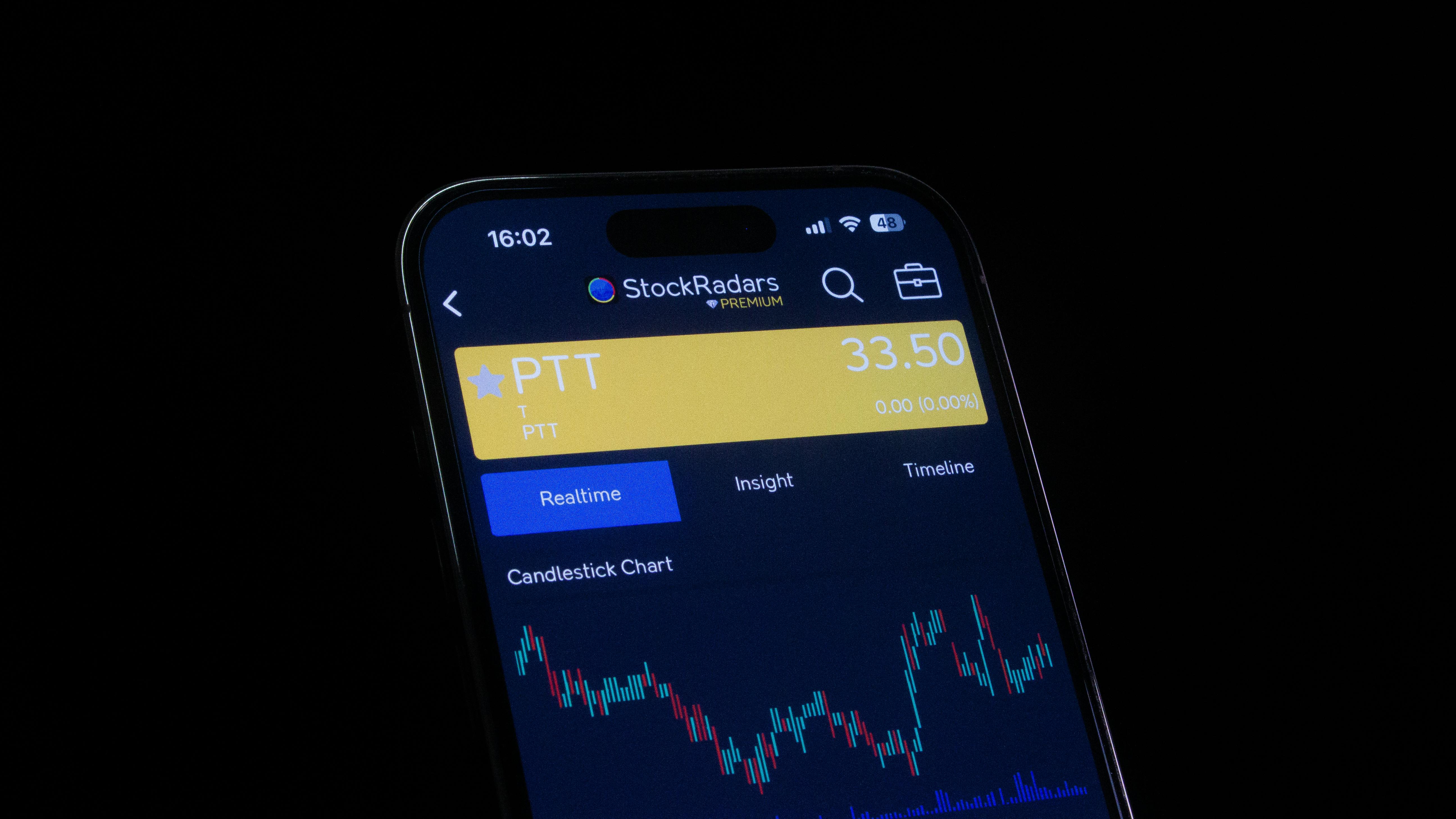

What’s crucial, and what most guides skip, is the importance of localization. I’m partial to Alegra for first-timers—it feels built for Salvadorans. That said, my thinking evolved: once you learn the basics, platforms like eToro and Binance open more doors. But don’t rush! You’ll avoid headaches if you start with tools designed for local beginners, not global pros.

Beginner Mistakes to Avoid

Here’s where most first-time Salvadoran investors trip up, and—believe me—I’ve made some of these errors myself back in the day. I’ll break them down not as shaming, but hard-earned wisdom (with real anecdotes and the advice I wish someone had given me):

- FOMO funding: Big deposits because of social media hype—a trap that leads to risky moves and regret when the market swings suddenly.

- Ignoring education portals: Most platforms offer interactive guides—skip these and you’ll miss vital steps like asset allocation, risk levels, and withdrawal procedures.

- No diversification: Putting all funds in one asset (e.g., Bitcoin) increases risk. Even a two-asset mix is safer.

- Not verifying withdrawal channels: Some platforms restrict payout options after sign-up—especially important for Salvadorans who want cash-out or local transfers.

- Copy trading blindly: Following social “gurus” on platforms like eToro can be risky if you don’t understand their strategies or risk profiles.

Conclusion: Investing in El Salvador’s Digital Future

Reflecting on my early days, it’s bonkers how far El Salvador has come in digital investing—and how much easier, safer, and more empowering the process now feels. Honestly, thinking about it differently each year, it’s clear: The old barriers (high minimums, foreign-only platforms, lack of local support) are breaking down, replaced by tools and communities that meet us where we really are—mobile, mostly Spanish-speaking, and eager to learn in real time.

But, the journey is personal. If I’ve learned anything, it’s to pace yourself, ask questions (even “obvious” ones), and stay curious. The digital landscape isn’t static; regulatory shifts, new platforms, and evolving educational resources mean you’re never “done.” Beginners (like I was!) who stay engaged and tap into local communities see far better results, not just financially, but in confidence and knowledge.